OUR THINKING

The Rise of AltNets in the UK

There is a huge demand for ultrafast connectivity, with both consumers and businesses embracing the digital revolution.

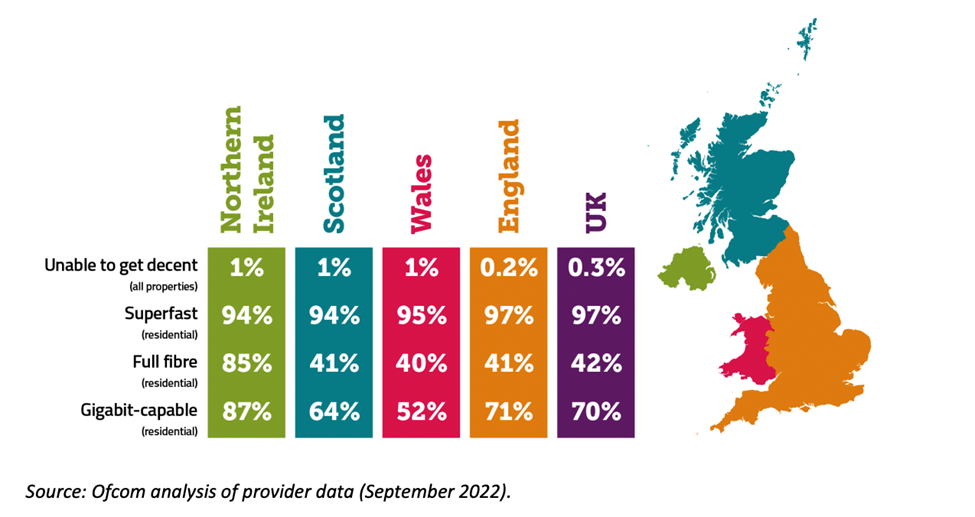

According to data released by OfCom, the government’s telecom regulator, the UK has a variety of available fixed broadband services such as Copper, Fibre to the Cabinet, Hybrid Fibre Coxial Cable, Fibre to the Home, and also Fixed Wireless access networks.

In 2021, there were 27.5 million broadband connections in the UK among which 85% of UK broadband customers get their services from one of the Big Four: the BT Group, Sky, Virgin Media, and TalkTalk. While telcos have traditionally been the dominant providers of these services, Fibre companies have emerged as strong competitors in recent years with more and more consumers opting for fibre-optic connections.

Full-fibre connectivity is the backbone for providing over-the-top innovative services and regulations have been relaxed to allow new players to come into the market leading to the rise of AltNet Fibre operators.

In addition to private equity-funded programs, there are government-backed initiatives to improve connectedness across urban and rural areas with mandatory full-fibre connectivity for newly built homes, business premises, and community-led rollouts.

Unlike traditional broadband provider ecosystems i.e. Reseller – Wholesaler, fibre companies use their own fibre-optic infrastructure, enabling them to offer faster and more reliable connectivity with flexible packages, competitive pricing, advanced technologies as well as personalized customer service. CityFibre has been the main Fibre catalyst in the UK as an Altnet Wholesaler but other AltNets such as Community Fibre, Jurassic Fibre, Giganet, Neos Networks, etc. are also playing a combined retailer-wholesaler role when it comes to expanding their reach and growing at an exponential rate.

Reshaping the Future of Fibre

Industry experts predict that the overall quantum of investments going into Fibre connectivity across the UK and EU is likely to be to the tune of 50B EUR by 2025. In this dynamic market, the leading telecom operators will be on their toes as the AltNet challengers continue to grow their market share. As AltNets vie with the incumbents, they will face roadblocks such as market consolidation, price erosion, lack of land rights, and labour force shortage. Lack of awareness about their offerings and differentiated customer experiences further adds to the challenge. However, despite what might seem like an uphill task, AltNets are growing at an exponential rate and slowly winning over communities hungry for ultrafast broadband services.

Meanwhile, despite the challenges posed by Fiber companies, Telcos in the UK have also been adapting to the evolving market. Many have begun accelerating their own fibre-optic broadband packages and have invested in upgrading their infrastructure to keep up with the increasing demand for high-speed internet. While new AltNets are gradually expanding, traditional Tier 1 operators have realized that running copper and fibre networks in parallel is both expensive and inefficient. A ‘Fibre switchover’ strategy is necessary to stimulate demand for Fibre, enable new networks to quickly scale up and ensure a smooth transition process for customers.

Overall, the competition between Fibre companies and Telcos in the UK has benefited consumers, as it has led to a greater range of options and more competitive pricing. As the demand for high-speed, reliable internet connectivity continues to grow, it is likely that both Fibre companies and Telcos will continue to evolve and adapt to meet the needs of consumers and businesses alike.